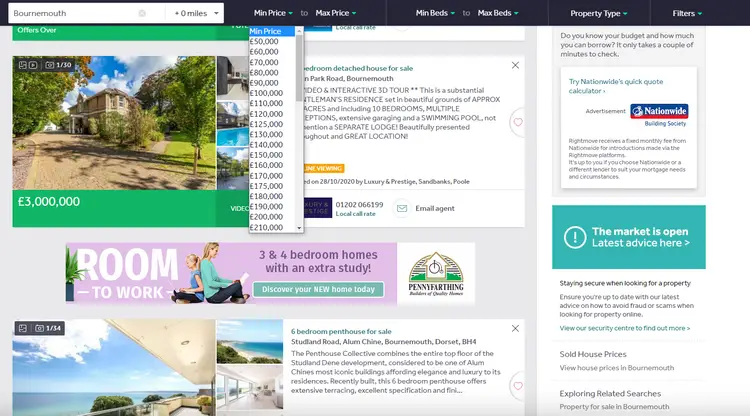

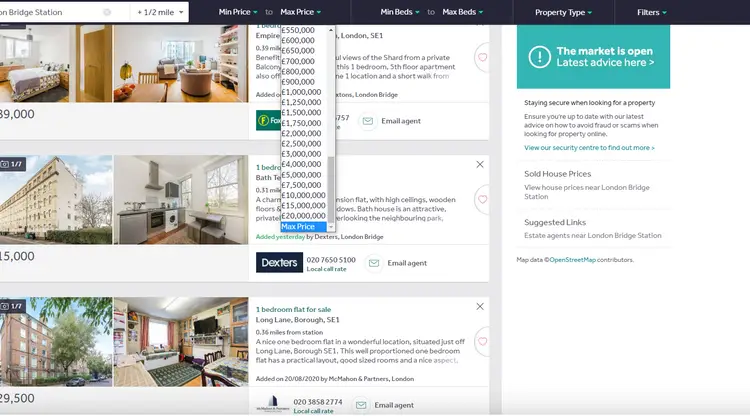

When you decide to sell your house, the price you sell it at is very important. If you get the price wrong you could face months of waiting for viewings and end up not sell your house at all. Most estate agents will list your property on Rightmove as well as on their own website. Rightmove has price bands that people search for their next home.

So why are the Rightmove Price bands important for selling your home? Rightmove price bands are important to know when you set your list price to make sure you maximise your chances of selling your house. Home buyers search in specific price ranges, for example £150,000 to £200,000 or £200,000 to £250,000. Which means if you price at £200,000 your house will appear in both searches.

Before going into more detail on this, here’s a list of the Rightmove price bands and how these increment.

Rightmove price bands:

- No minimum to £50,000.

- £50,000 to £120,000: £10,000 increments.

- £120,000 to £125,000: One £5,000 increment.

- £125,000 to 170,000: £10,000 increments.

- £170,000 to £175,000: One £5,000 increment.

- £175,000 to £300,000: £10,000 increments.

- £300,000 to £500,000: £25,000 increments:

- £500,000 to £700,000: £50,000 increments.

- £700,000 to £1,000,000: £100,000 increments.

- £1,000,000 to £2,000,000: £250,000 increments.

- £2,0000,000 to £3,000,000: £500,000 increments.

- £3,000,000 to £5,000,000: £1,000,000 increments.

- £5,000,000 to £10,000,000: £2,500,000 increments.

- £10,000,000 to £20,000,000: £5,000,000 increments.

Pricing your house to fall into Rightmove price bands

As explained in the quick answer above, you are best to price your house to within specific search ranges. But do this with an eye on the Rightmove price bands listed above. Make sure you put your house at the top of each price band to increase your chances of your home being found on as many searches as possible.

For example, you are better to price your house at £200,000 rather than £199,995. As although £199,995 sounds cheaper you are potentially losing out on searches.

Property buyers will often search on ranges of say £150,000 to £200,000 and others from £200,000 to £250,000. Buyers tend to have a bit of leeway over the top of their budget. For example, if a buyer can afford say £250,000 they may search up to £260,000.

The reason for this is they know they can usually haggle on the price a bit. With this in mind you might like to take a quick read of this article on what % is a cheeky offer.

If your house is priced at £199,995, it will only appear in the £150,000 to £200,000 search. Which means you’re potentially missing out on those buyers who have a budget of £200,000 and above.

But if you change the price to £200,000, it will now appear in both the above search ranges. Which means your house will now appear to those home buyers who can afford houses up to £200,000, but also to those that are looking for a house priced at £200,000 and above.

If you are selling your house and had no viewings

If you are selling your house and not had any viewings this might be because your house is in the wrong Rightmove price band. Not only should your house be priced according to it’s size, location and condition in relation to other similar houses. But you should think about likely searches on Rightmove too.

For example, if your house is priced at £255,000 and more home buyers search in the range £200,000 to £250,000, you will miss out on this target market. By reducing your house to £250,000 instead you will then be included in this price band too.

If your house is already on the market and you are trying to work out why you’ve not had any viewings, you might want to take a read of this article about what to do if your house has been on the market for 2 weeks with no viewings.

Stamp Duty price bands

When you price your house to sell you also need to keep a mind to Stamp Duty price bands too. As I write this article Stamp Duty (SDLT) rates are reduced because of Covid 19. However, this only lasts until 31 March 2021 when rates go back to normal.

The table below shows the SDLT rates that will apply from 1 April 2021.

| Property or lease premium or transfer value | SDLT rate |

|---|---|

| Up to £125,000 | Zero |

| The next £125,000 (the portion from £125,001 to £250,000) | 2% |

| The next £675,000 (the portion from £250,001 to £925,000) | 5% |

| The next £575,000 (the portion from £925,001 to £1.5 million) | 10% |

| The remaining amount (the portion above £1.5 million) | 12% |

Fortunately the extra amount the buyer will pay in Stamp Duty when a property moves into a high band is the higher rate of Stamp Duty on the excess of the price over the lower band.

For example, the SDLT on a house sold for £275,000 will be £3,750. This is calculated as 2% on £125,000 and 5% on £25,000, (i.e. £275,000 – £250,000 = £25,000 in the 5% tax band).

Can you put my house on Rightmove yourself?

You can put my house on Rightmove yourself if you use companies like Visum. Visum act as an intermediary as Rightmove do not permit private sellers to advertise directly. Rightmove will only deal with estate agents directly, but are happy to also deal with Visum.

Visum charge a fee, but included in this fee is to list your property on Rightmove and other house sale portals like Rightmove, including Zoopla.

So instead of your house sale commission costing an average of £4,300 with an estate agent near you, you could pay as little as £75 to sell your house on Rightmove yourself with Visum. But its important to price your property right and choose the correct Rightmove Price Band first before listing your house for sale.

I hope this article has helped about Rightmove Price bands

If this article has helped on ‘Rightmove Price bands’ please share it on your favourite social media site.

Also, if you have any questions, please feel free to comment below too. Alternatively, if you need more help, please feel free to contact us on our contact us page here. Or join the discussion and ask your question in the property forum.