Is a leaking roof covered by insurance?

You may have a leaking roof but not sure if it’s covered by insurance. You may also be wondering if any of the damage caused as a result of the leak is covered by your home insurance too. But on the other hand you may have claimed on your insurance for a leaking roof, but your insurance company have refused the claim. Which is why it’s important to understand whether or not insurance covers your leaking roof.

Home insurance covers leaking roofs if the damage is caused by a storm or what’s referred to as damage by a one-off event. But if your leaking roof is down to wear and tear the insurance company won’t cover the cost of repairs. If a storm damaged your roof you’d expect to see damage to the exterior.

When is a leaking roof covered by insurance and when is a storm a storm?

A leaking roof is only covered as a result of storm damage, which is known as a one-off event. But the definition of a storm varies from one insurance company to the next. You’ll need to read the small print to find out what constitutes a storm according to your chosen insurance company.

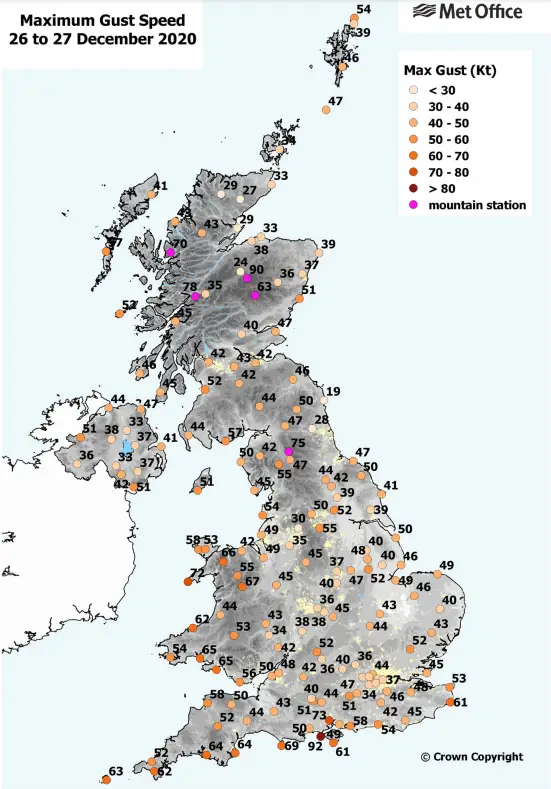

Many insurance companies will only cover for storm damaged over a certain wind strength. This is often measured using the Beaufort Scale or wind speed. Insurance companies will often refuse to pay for a leaking roof if the damage was caused by winds of less than a certain strength, even if it was caused by a storm.

Many insurance companies use storm force 10 on the Beaufort Scale, which represents wind strengths between 55 to 63 mph (89 to 102 km/h). Which means if the damage to your roof was caused by winds of less than 55 miles per hour, your insurance company would not honour your claim.

Is the maximum wind gust speed included in insurance policies flawed?

There is a flaw to this wind-gust speed policy. The actual weather and wind speeds experienced by you can be different from what is recorded at your nearest weather station. For example, there can be extremely strong localised gusts of wind in certain areas that are higher than what was recorded by the local weather station.

If in doubt and if you feel your insurance company has been unreasonable, contact the Financial Ombudsman Service and complain. You should take a read of this leaking roof case study by the Financial Ombudsman Service.

In this case study the insurer said they would only consider a claim for storm damage if there were wind speeds of level 10 and above. But the wind speeds hadn’t been that strong. The Ombudsman upheld the the claim and advised the insurance company to pay out for the roof damage. Leaking roof case study example one.

How to check storm strengths for the purpose of an insurance claim for a leaking roof

The easiest way to check for maximum wind gust speeds is to visit the Met Office. You can check the dates of storms and the level of wind speed in your region. This is an example of a Maximum Gust Speed Map of the UK courtesy of the Met Office.

However, just because the maximum wind speed gusts at your nearest weather station are below the level set by your insurance company, this doesn’t necessarily mean your claim is not valid.

How to make a successful insurance claim for a leaking roof – even if the recorded wind gusts are less than your insurance terms and conditions

One of the best ways to be sure of a successful insurance claim is to choose a good insurance provider in the first place. But also, you should always complete the insurance proposal form correctly and honestly. If you don’t you may find the insurer will not honour your claim.

To help make sure your claim for a leaking roof is successful here are a few tips:

- If you are able to do so, take video evidence of the storm. But stay safe when out in storms or film it through your windows.

- Video the leaking roof and take photos of any damage caused.

- Take photographs of your roof damage on the day following the storm.

- Take photographs of your street to show any fallen debris caused by the storm.*

- Check nearby properties for roof damage too.

- Take photos of any damage to neighbouring properties. This will help prove your house wasn’t the only house affected by the storm.*

- Check your insurance policy documents before you make a claim to check your cover.

- Consider using an independent contractor to assess the roof damage and have them prepare a report of the damage. But you should get the insurer to agree to this, otherwise they may not pay for the assessment.

- Before you claim make sure the leak is not due to penetrating damp. This can happen as a result of dislodge tiles or slates or due to the flashing on the chimney requiring attention.

- If your insurance company refuse your claim complain to the Financial Ombudsman Service. But before you do, follow your insurance company’s complaints procedure.

* Both of these will provide evidence of stronger winds should your insurance company dispute your claim. This photographic evidence will also prove useful if you need to complain to the Ombudsman.

Homeowners insurance will not cover for wear and tear or damage caused as a result of poor maintenance

Most insurance companies will include an exclusion clause for wear and tear. Which means if your leaking roof is as a result of poor maintenance and upkeep your claim is likely to be refused. But even if there are signs of wear and tear and your leaking roof has been caused by storm damage, your insurance company may still pay out.

In another leaking roof case study when a homeowner’s roof was damaged in a storm and, the insurance company said that the nails securing the roof slates had worn out. The insurer refused the claim on the basis that the policy didn’t didn’t cover wear and tear.

However, in this leaking roof case study the homeowners asked for a second contractor to assess the roof damage. The insurer agreed to this second assessment and the report showed that the damage was because of the storm. Which is largely because the new report didn’t mention wear and tear. Leaking roof case study example two.

If your roof is rotten this will be the result of ‘wear and tear’

Rot in your roof timbers will happen over a period of time. So if you have a leaking roof when your roof has gone rotten, the cause of the leak is likely to have happened some time prior. This will be considered poor maintenance by your insurer. As a result of the lack of maintenance, your insurance company is unlikely to pay-out on a claim for a leaking roof.

But even in the case of wear and tear the Financial Ombudsman will weigh up the facts of the case. This is because even if the property was in perfect condition before the storm occurred, the damage caused may not be as a result of wear and tear.

In other words, the question that needs to be answered; is it likely the damage caused by the storm would have happened even if the roof was in a good state of repair? But to be on the safe side make sure you maintain your roof. If you have any broken or slipped tiles or slates, have these fixed as soon as you notice them.

If you have a flat roof extension on your house and this is in a poor state of repair, it’s unlikely your insurer will cover a claim if you get a leaking roof after a storm.

Even the Financial Ombudsman is unlikely to uphold the claim in this case if your flat roof is in a poor state of repair. It might be the storm merely highlight an existing problem. In which case your insurance company would be right not to honour the claim.

Will your insurance cover for a leaking roof caused by snow?

A leaking roof can be caused by heavy snow fall. High volumes of snow can accumulate on a roof. As a result of the weight of snow this can damage the roof. The weight of the snow may cause the roof to collapse, which would result in a severe leak. But sometimes it’s not until the snow thaws when the roof damage is uncovered and the leak begins.

You may find your insurance company will refuse the claim if they don’t consider the snow fall recorded was sufficient to constitute a snow-storm. As in this next case study when a claim for damaged caused by heavy snowfall was rejected by the insurer. A part of the homeowners claim was upheld, but only because they had taken out an accidental damage policy too.

It’s more likely that snow will only collect in large amounts on flat roofs rather than on the sloping roofs of your house. Which means you need to make sure your flat roofs are maintained properly. If your flat roof fails due to heavy snow it may be as a result of a poor state of repair. Leaking roof case study caused by snowfall.

Will your insurance cover for a leaking roof caused by falling trees?

Another cause of a leaking roof is a tree falling on your house. If this happens your insurer should honour the claim. But your claim will only be covered if you disclosed the close proximity of the trees to your home on the insurance proposal form. If you failed to disclose the fact you have trees within a set distance from your property, your insurer is quite within their rights to refuse your claim.

Final thoughts about will insurance cover your leaking roof

Usually with valid claims for a leaking roof as a result of storm damage the insurance company will pay for the roof to be replaced. This is as well as for the internal damage (i.e. consequential damage) caused water ingress, as a result of the roof damage.

Also be aware your leaking roof could be as a result of faulty workmanship. If poor workmanship is a fault and is what has caused the leaking roof, your insurer is unlikely to cover the claim.

Also, make sure your buildings insurance is for the correct rebuild cost. Most insurance companies include a clause in their insurance policies that could limit your claim. If an insurer discovers you are underinsured, they may only pay-out a percentage of the actual claim.

This is best explained by way of an example:

- On the assumption your house rebuild cost is £250,000 (this is not it’s market value – see below).

- Let’s assume you are insured for a rebuild cost of £150,000.

- If you had a claim for storm damage and a leaking roof for £15,000.

- In this example you are underinsured by £100,000. Which means you are 40% underinsured.

- It could mean your insurance company may limit the claim by up to £6,000.

- Based on the ‘averaging rule‘ insurers apply, in this example you may only get £9,000 of the total £15,000 claim.

It’s worth mentioning that the rebuild cost of your house is not the same as its value. These are totally different. For example, a three-bed house in London is likely to cost a similar amount to rebuild to the same size house in Leeds. Subject to differing labour rates between London and Leeds of course. However, the value of a three-bed house in London is likely to have a far great market value than the same sized house in Leeds.

The only sure way to get your rebuild cost correct is to ask a builder or a surveyor to calculate this for you. Some insurance companies offer this as a service. Some will even part-pay the survey cost. Make sure to update this on a regular basis.

Finally, make sure to keep your property in a good state of repair. This way you protect your home from rain and snow. Plus it will make insurance claims easier should you need to claim.

I hope you’ve enjoyed this article about will insurance cover your leaking roof

If you’ve enjoyed this article about “will insurance cover your leaking roof”. If you have please share it on your favourite social media site.

Also, if you have any questions, please feel free to comment below too. Please also share any of your experiences with properties you’ve bought. Alternatively, if you need more help, please feel free to contact us on our contact us page here. Or join the discussion and ask your question in the property forum.