I decided to write this article after trying to find the rateable value of one of our properties for P11D benefit in kind purposes. But this proved difficult to say the least and now I know more than I did before about how to find the rateable value of a home.

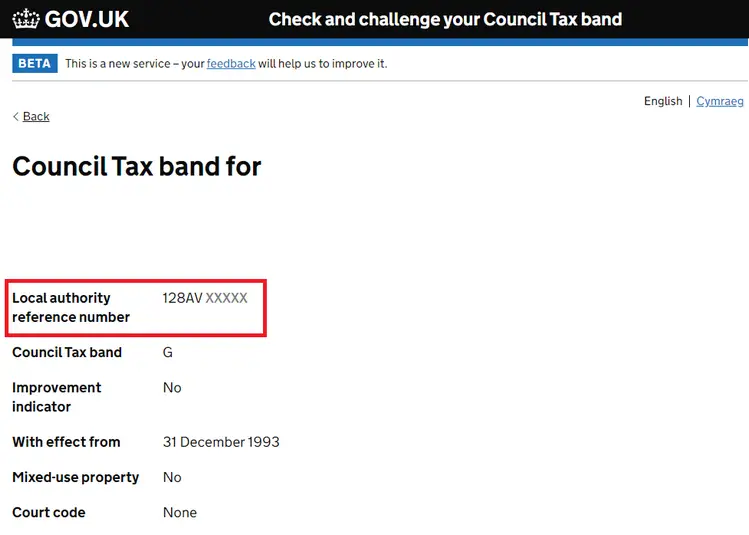

To find the rateable value of a home contact the Valuation Office Agency (VOA) and quote the Council Tax Reference, property address and local authority reference number. You can also find the rateable value on a water rates bill, as some base their water and sewage charges on rateable value (RV).

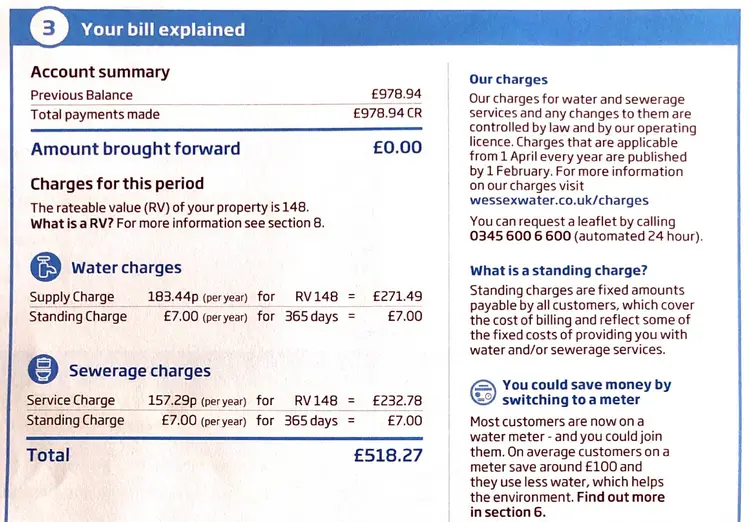

How you find rateable value of a home from water rates bill

One way to find the rateable value of a home is to look on the water rates bill. In the above image you can see where it says “RV148”, which is the rateable value for this property. It is this value that’s been used to calculate the water supply charge and the sewerage service charge.

However, I checked the water rates bill for another of my properties, and this didn’t show the rateable value. If this isn’t present on the water bill for the property concerned, you will need to contact the Valuation Office Agency instead.

To find out more about the VOA, please visit their website Valuation Office Agency.

To find your local authority reference number, you need to search for the Council Tax Band. When you search on this page, and enter your postcode, you’ll end up on a page that looks like the above image. You will see the Local authority reference number is boxed in red.

What is the rateable value of your house?

The rateable value (RV) of a house is the estimated annual rent the property would rent for if it were available to let on the open market at a fixed valuation date. Rateable values from 1 April 2017 have been based on a valuation date of 1 April 2015.

What factors are used to calculate rateable value?

- Age of the property.

- Size of the property.

- Quality of finish.

- Geographical location.

- Local transport facilities.

- Other available amenities.

When would I need to know the rateable value of a domestic property

Probably the only time you will need the rateable value (RV) of a domestic property is when you calculate its value for benefits in kind purposes to put on an employee’s P11D.

When domestic properties moved to being taxed with Council Tax instead of with rates, the rateable value became more or less redundant. But for non-domestic properties, it is the rateable value that’s used for calculating rates payable.

However, domestic properties still have a rateable value, it’s just not as easy to find.

Finally, you may also like to discover how you could save you up to £71,475 when you buy your next house if it would originally cost £350,000. Alternatively, if you propose to buy your next house for £250,000, the saving could be up to £51,852 instead.

To find out more, plus to get hold of my free mortgage savings calculator tool, please take a look at my video course about how to sell your house in under 2 weeks for more money.

I hope you’ve enjoyed this article about how do I find the Rateable Value of a Home?

If you’ve enjoyed this article about “how do I find the Rateable Value of a Home?“ please share it on your favourite social media site.

Also, if you have any questions, please feel free to comment below too. Alternatively, if you need more help, please feel free to contact us on our contact us page here. Or join the discussion and ask your question in the property forum.